As the DDR5 market is poised for a significant price surge, industry insiders suggest that SK Hynix’s decision to increase DRAM chip prices will have a ripple effect on memory stick costs, likely to be followed by Samsung and Micron. The surge in demand for high-bandwidth memory (HBM) driven by artificial intelligence applications, coupled with the reallocation of resources from DDR5 development, has led to a delay in the expected price increase.

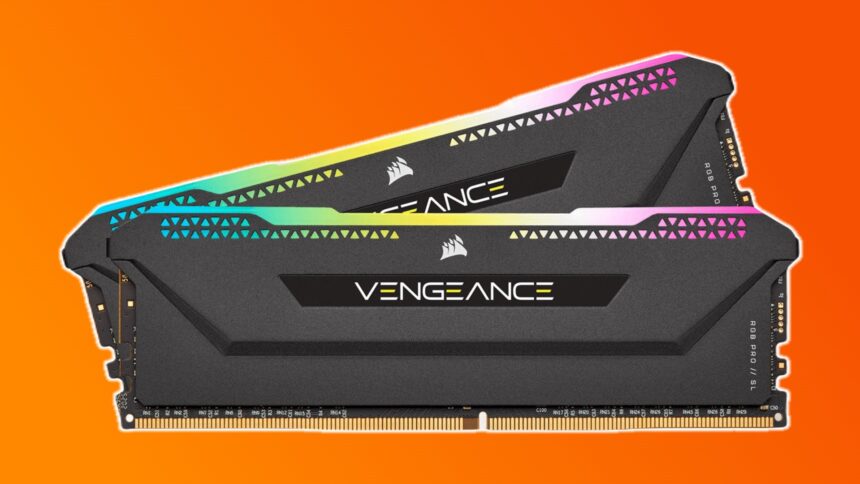

With all major indicators pointing to a prime opportunity, consider seizing the moment to acquire the elite gaming RAM, such as the Corsair Vengeance LPX. The value surge isn’t solely impressive, but an expected rebound is plenty of reason to get in before the changes take effect.

Taiwan’s Financial Daily reports that SK Hynix is poised to hike its DDR5 prices by 20%, representing a 15% increase from its previous quote, according to industry sources. As supply chain constraints persist, global demand for DRAM and NAND flash is expected to surge, driving prices to unprecedented highs by 2025, with manufacturers poised to reap more than double their 2023 annual revenue, according to TrendForce’s projections.

One key factor driving this variability is the high-bandwidth memory (HBM), a crucial yet expensive component for AI applications. Despite comprising less than 5% of overall memory shipments, their pricing and production requirements still have a significant ripple effect on the manufacture of other types of memory.

As demand for high-bandwidth memory (HBM) surges ahead of schedule, manufacturers are redirecting their DDR5 production capacity to meet the shortfall, effectively exhausting their capabilities until at least 2025.

The top result will be enhanced for customers, as companies like SK Hynix, Samsung, and Micron are incentivized to increase the value of their available DDR5 offerings to compensate for decreased manufacturing capacities. To curb demand and prevent a situation where DDR5 allocations run out completely.

While the prospect of a 20% increase may seem concerning at first, it’s essential to reaffirm that this projected growth is expected to have a profound impact on overall value. While that’s a reasonable justification to buy now, we shouldn’t anticipate encountering the kind of scarcity and unavailability problems that plagued graphics card sales during the pandemic, for instance.

As advancements in RAM continue to unfold, a recent trend has emerged: Nvidia GPUs boasting double the traditional Video Random Access Memory (VRAM).